[ad_1]

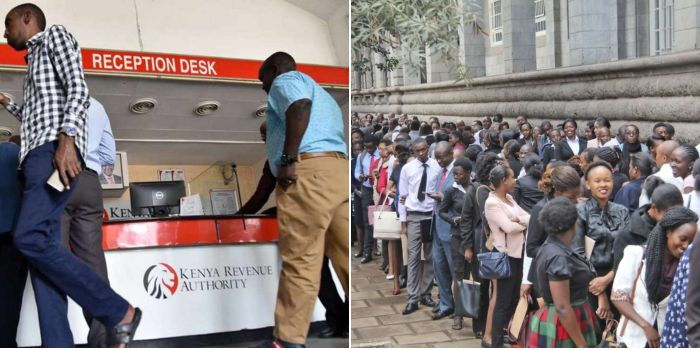

Salaried staff will take dwelling much less pay in February following the implementation of the brand new charges by the Nationwide Social Safety Fund (NSSF).

NSSF elevated the obligatory pension deductions for the February 2024 payroll, which means that Kenyans should pay between Ksh420 and Ksh1,740.

The brand new charges can have a big impression on the take-home pay for staff who must endure harder occasions sooner or later because of the powerful financial system.

To place it into perspective, previously 12 months alone, the federal government has taken an enormous chunk of the employee’s payslips, following the implementation of the Finance Act 2023, which launched the obligatory Housing Levy, the introduction of recent tax brackets for the Pay as You Earn (PAYE) amongst others.

An try to dam the gathering of the Housing Levy was thwarted in court docket because the Court docket of Attraction allowed the federal government to maintain accumulating the levy till January 26, 2024, when the ultimate verdict shall be issued.

Which means from July 1, 2023, the federal government has been accumulating 1.5 per cent of Kenyans’ gross pay deducted for the Reasonably priced Housing program, with their employer matching the deduction.

With all these elements mixed, Kenyans will see a important dent of their February pay slip, as the federal government seeks to extend income assortment to succeed in over a trillion within the subsequent monetary years.

NSSF Charges

In keeping with the NSSF Act, the brand new charges are primarily based on a employee’s wage scale which is split into two; Higher Incomes Restrict (UEL) for workers incomes Ksh18,000 and above and Decrease Incomes Restrict (LEL) for these incomes under Ksh18,000.

Staff’ contributions within the decrease restrict (Tier 1 class) shall be primarily based on the revised decrease restrict of Ksh7,000, up from the present Ksh6,000.

Which means the workers will contribute Ksh420 versus the earlier Ksh360.

Then again, workers within the Higher restrict shall be primarily based on the revised restrict of Ksh36,000, whereby staff pays Ksh1,740 up from Ksh1,080.

In each cases, the employers will match the contributions.

Efficient February 9, 2024, the overall contributions will enhance from the present Ksh2,160 to Ksh4,320.

President William Ruto talking throughout a gathering with Jubilee leaders at State Home Nakuru on January 11, 2023.

PCS

How the Payslips Can be Affected

Except for the 1.5 per cent Housing Levy, the federal government launched the expanded PAYE which elements in two new tax brackets; 35 per cent PAYE for workers incomes above Ksh800,000 month-to-month and 32.5 per cent for these incomes between Ksh500,000 and Ksh800,000.

As an illustration, a employee incomes Ksh600,000 gross pay will remit Ksh195,000 whereas one other employee incomes Ksh1 million shall be taxed Ksh350,000.

Nevertheless, for many Kenyans, the typical staff earn a median of Ksh20,000 primarily based on the Kenya Nationwide Bureau of Statistics (KNBS) information. Therefore, a employee with a Ksh20,000 pay slip will earn a internet pay of Ksh17,750.

[ad_2]