[ad_1]

There are authorities applications that present monetary reduction to tax evaders, by means of such schemes, the federal government can determine to waive off all or a part of the monetary penalties imposed on its residents primarily based on sure situations.

In some instances, the federal government may enable taxpayers to pay again the complete amount of cash accrued in penalties in straightforward installments over an extended timeframe or the federal government can as nicely determine to situation a reduction to the tax defaulter by making them partially pay the defaulted quantity.

Regardless of the existence of such insurance policies by the federal government, most individuals usually confuse these measures with both tax amnesty, waivers, and even tax write-offs.

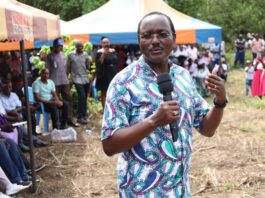

KRA Commissioner for Home Taxes Rispah Simiyu talking throughout a gathering at Ole Sereni Resort, Nairobi on October 24, 2023.

Photograph

KRA

Tax Amnesty

The Finance Act 2023 launched a tax amnesty for curiosity and penalties on tax debt by inserting Part 37E into the Tax Procedures Act, of 2015.

Tax amnesty is just a limited-time supply by the federal government to a taxpayer to pay an outlined quantity, in trade for forgiveness of a tax curiosity and penalties regarding a earlier tax interval(s), in addition to freedom from authorized prosecution.

The amnesty applies to a individual with penalties and curiosity however has no principal taxes owing for durations as much as December 31, 2022. Nevertheless, for these with principal taxes from January 1, 2023, onwards, the excellent principal tax debt ought to be paid by thirtieth June 2024.

The tax amnesty commences on September 1, 2023, and shall stay in power till June 30, 2024. By accepting the phrases and situations of the amnesty, the taxpayer commits to honouring the cost plan settlement.

Kenya Income Authority constructing at Instances Towers

KENYANS.CO.KE

Tax Waiver

A tax waiver is when penalties imposed both for late submitting or non-filing of returns are lifted or executed away with fully by the income authority. Not like tax amnesty, the waiver will not be time-bound and will be executed anytime upon software by the taxpayer.

To get a waiver, the taxpayer must make an software letter to the commissioner detailing causes they want the penalties imposed both for late submitting or non-filing of returns to be uplifted or executed away with.

For a tax waiver to be granted, the software should be justified with supporting proof from paperwork, and the principal tax should have additionally been paid. The taxpayer should have additionally been tax-compliant on all different taxes.

Tax write-offs

It is a legit expense that may be claimed as a deduction and decrease your taxable earnings. A tax write-off can also be known as a tax deduction.

The most effective profit from a tax off is the discount of your taxable earnings, which in flip lowers the taxes it’s important to pay.

The Finance Act, of 2023 did away with sections of the identical Act which supplied for the write-off of taxes and tax waivers.

Due to this fact, KRA did away with the appliance, processing, or granting of waivers or write-offs on curiosity, penalties, and fines.

President William Ruto talking through the 2023 Taxpayers Day in Mombasa County on November 3, 2023.

Photograph

KRA

[ad_2]