[ad_1]

Photograph: Olivia BUGAULT, Anibal MAIZ CACERES / AFP

Supply: AFP

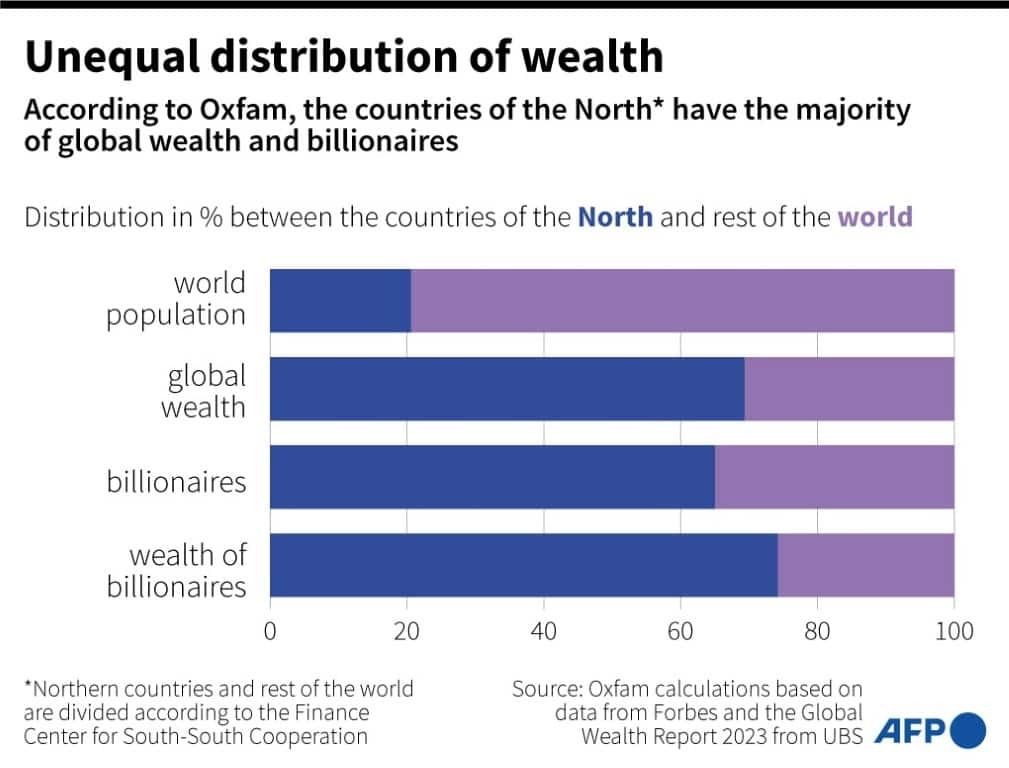

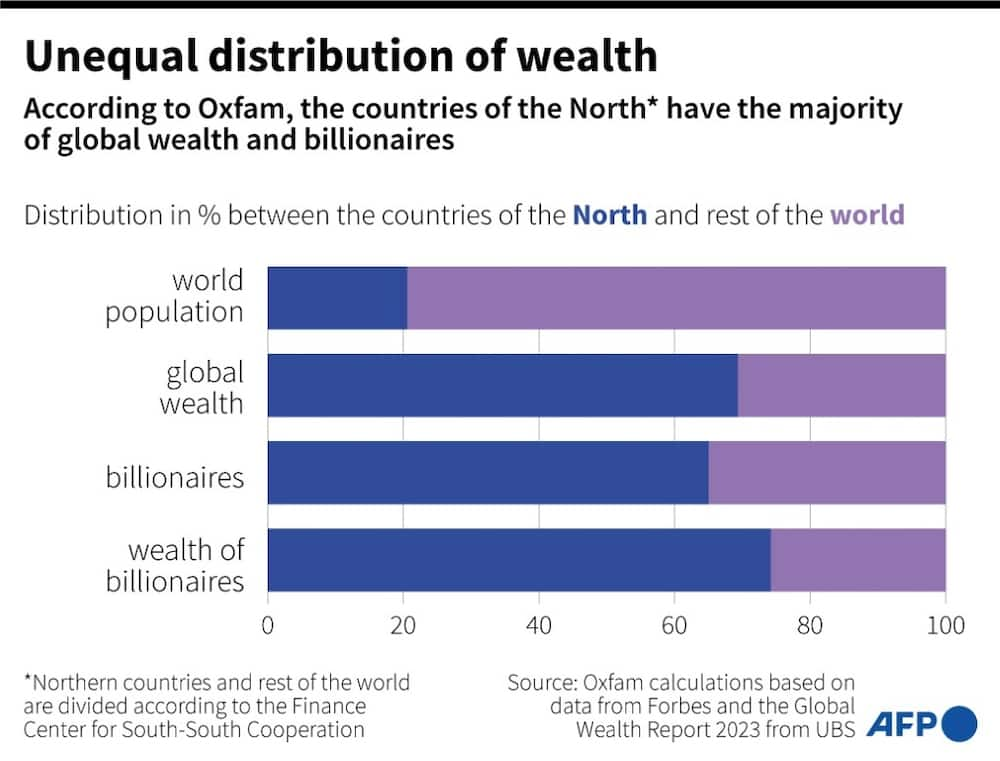

The world’s wealthiest 5 males have greater than doubled their fortune since 2020, the charity Oxfam stated on Monday, because it referred to as on nations to withstand the ultra-rich’s affect over tax coverage.

A report from the charity, revealed as the worldwide elite hobnob on the World Financial Discussion board in Davos this week, stated their wealth rose from $405 billion in 2020 to $869 billion final 12 months.

But since 2020, almost 5 billion individuals worldwide have grown poorer, Oxfam stated.

Billionaires are at the moment $3.3 billion richer than they have been in 2020, regardless of many crises devastating the world’s financial system since this decade started, together with the Covid pandemic.

Oxfam’s yearly report on inequality worldwide is historically launched simply earlier than the discussion board opens on Monday within the Swiss Alpine resort.

The charity raised issues over rising world inequality, with the richest people and corporations amassing better wealth due to surging inventory costs, but in addition considerably extra energy.

“Company energy is used to drive inequality: by squeezing employees and enriching rich shareholders, dodging taxes, and privatising the state,” Oxfam stated.

It additionally accused firms of driving “inequality by enterprise a sustained and extremely efficient battle on taxation”, with far-reaching penalties.

Oxfam stated states handed energy over to monopolies, permitting firms to affect the wages individuals are paid, meals costs and which medicines people can entry.

“Around the globe, members of the non-public sector have relentlessly pushed for decrease charges, extra loopholes, much less transparency, and different measures aimed toward enabling firms to contribute as little as attainable to public coffers,” Oxfam added.

The charity stated due to intensive lobbying over tax policymaking, firms have been capable of pay decrease company taxes, thereby depriving governments of cash that could possibly be used to financially assist the poorest in society.

Company taxes have considerably dropped in OECD international locations from 48 p.c in 1980 to 23.1 p.c in 2022, Oxfam famous.

To handle the imbalance, Oxfam referred to as for a wealth tax on the world’s millionaires and billionaires that it says might herald $1.8 trillion {dollars} every year.

The charity additionally referred to as to cap CEO pay and break up non-public monopolies.

Supply: AFP

[ad_2]